MediaCorp believes original content could boost its fledgling over-the-top offering, Toggle. Beset by technical issues and complications in securing premium Hollywood content, the service has labored to achieve market penetration since its launch in February.

Shaun Seow, CEO of the Singapore media conglomerate, says growth will come once technical issues with the platform and interface are resolved.

Seow also highlights the ongoing development of the content mix, which will increasingly be driven by local, and in some cases, web-original content.

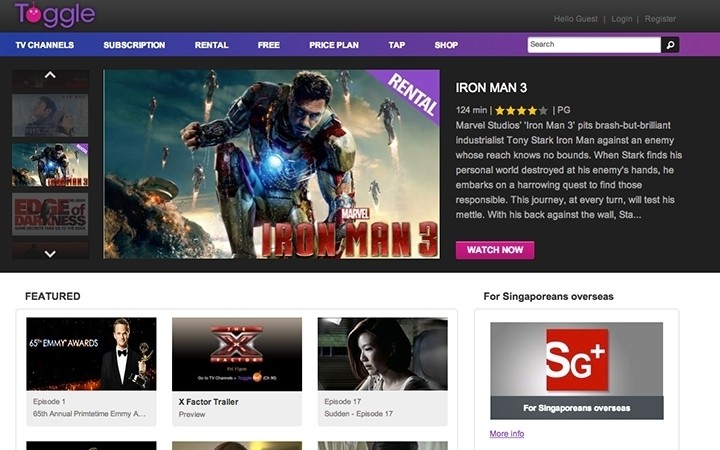

MediaCorp’s over-the-top (OTT) video service, Toggle streams linear channels, movies and free-to-air (FTA) content to local viewers.

The Prime package costs SG$9.90 (US$7.88)/month for access to just over 20 channels. Thematic SVOD packages are available for SG$5.34/month and a-la-carte channels can be purchased for SG$2.14/month.

Toggle provides 987TV, Channel NewsAsia, Channel 8i and Toggle Live, as well as catch-up viewings of FTA channels for free.

The service will extend the life of MediaCorp’s library of content, creating new windows for shows and advertising opportunities. The Toggle-It-First option enables viewers to watch five episodes ahead of the FTA broadcasts for Channel 8 Mandarin dramas among others.

Toggle is also being leveraged as a platform for MediaCorp’s aural brands, with youth-targeted radio station 987 establishing a channel to extend value for radio advertisers.

Seow points out Toggle can help with content that does not fit the FTA content guidelines of the Media Development Authority, saying “If we produce a Big Brother-style show, whatever we cannot run on prime-time free-to-air, we can run 24/7 on Toggle as a complementary service.”

Less than six months since its launch, the promise of Toggle is clear as “a vehicle to recapture digital audience and recover some of the digital advertising,” says Seow, in an interview with Media Business Asia.

Toggle’s subscription fees represent a new revenue model for MediaCorp.

Realizing that success, however, has been complicated. Technical issues and questions about the user interface developed by Israeli firm Tvinci – brought in one month before the launch – have hindered growth for the new service.

Toggle currently splits the content and interactivity features of the service across two separate apps.

“Thus far, the performance could be better” Seow concedes, adding “the technical glitches are something we recognized and we are pushing ourselves internally to see how we can do it better.”

While Seow and his team improve Toggle, the external OTT landscape in Singapore looks increasingly competitive.

StarHub’s authenticated TV Anywhere service currently offers 65 linear and on-demand channels OTT to its 530,000 pay-TV subscribers. While SingTel has yet to pursue this option, an OTT offering seems a likely addition given their 406,000 IPTV, 561,000 broadband and 3.85 million mobile subscribers.

One reason offered for the slow initial take-up is the Singaporean consumers’ relatively high usage of peer-to-peer video sharing sites to view pirated content.

Data from piracy experts MarkMonitor suggest that approximately half of Singaporean internet users visit websites with pirated content each month, ranking them as the highest per capita users of pirated content websites in Southeast Asia.

The perception of Singapore as an unsafe location for digital content is having a negative on Toggle, as MediaCorp struggles to convince major Hollywood studios to license new movies and shows.

“Some studios are rather worried about DRM issues on OTT, so they have been reluctant to offer certain content,” comments Seow. Recently, however, Disney licensed Iron Man 3 as a paid on-demand offering for Toggle.

Relying on Singapore’s vast broadband pipes, viewers have easy access to foreign content, says Seow, which makes overseas content “commoditized”.

For Toggle, Seow prefers to focus on what he can control. “We cannot beat Netflix at top-50 content, but we can be very good at offering original, local content.”

As a leading independent consulting and research provider focused on Asia media & telecoms, MPA offers a range of customized services to help drive business development, strategy & planning, M&A, new products & services and research. Based in Hong Kong, Singapore and India, MPA teams offer in-depth research reports across key industry sectors, customized consulting services, industry events to spread knowledge and unlock partnerships, and publications that provide insights into media & telecoms.

All Media Partners Asia articles >Thank you for submission

Once you activate the account, your subscription entitles to receive 3 months of complimentary access to ‘The Digest’, MPA’s monthly email analysis,updates across TMT with exclusive industry interviews and data.